Recently, China's National Energy Administration has announced the construction and operation of PV power generation in 2022. A record 87.4GW of new PV capacity will be installed in the year 2022. Therefore, the trend of China's PV market in 2023 shall be analyzed as follows.

01 2022China's PV Installed Cpacity and 2023 Forecast

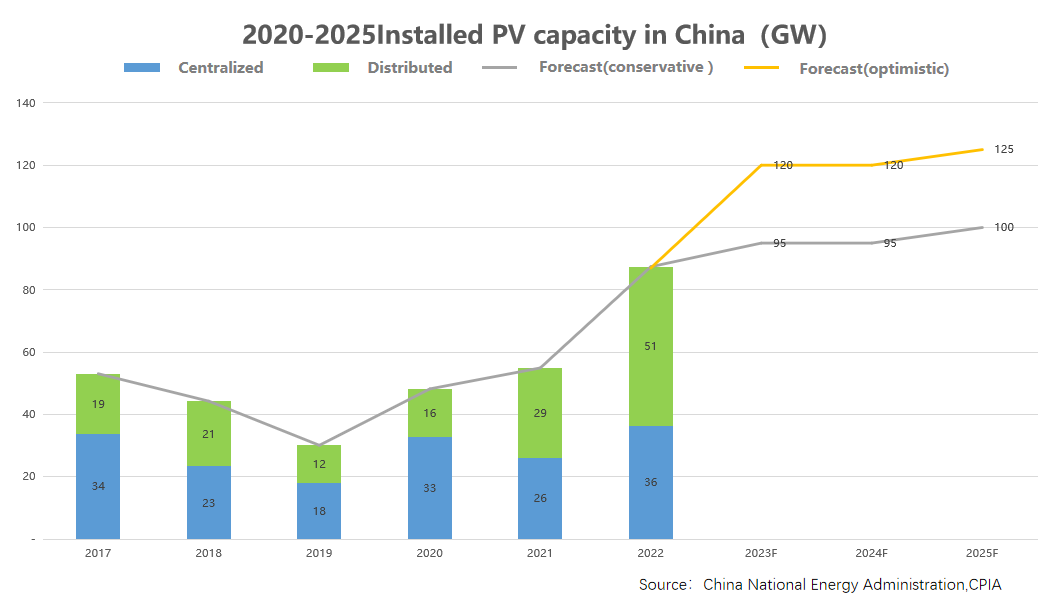

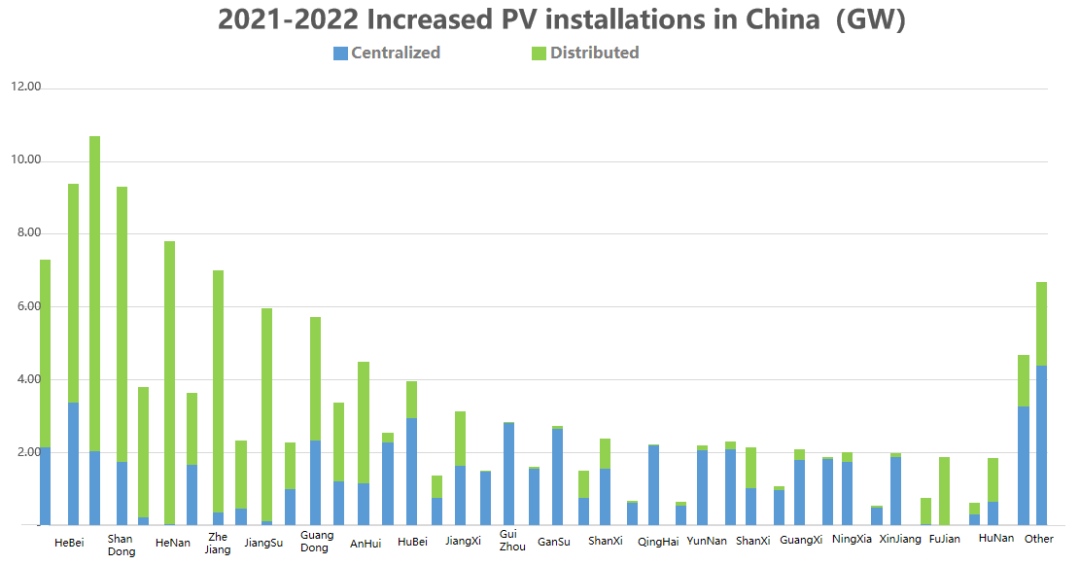

In 2022, the newly increased PV installed capacity of China is 87.4GW, up 59% from 2021, becoming the highest installed capacity in domestic history, of which 58% was distributed, creating a new record. According to the prediction of China PV Association, China's newly-increased PV installed capacity will have a great chance to step into 100GW level in 2023, and will maintain an annual average increment of 95-125GW during 2023-2025.

02 China's Centralized PV Market Forecast in 2023

The high module prices in 2022 led to a delay in some centralized projects, accounting for only 42% of the total new installed capacity. This year, module prices have fallen sharply, which has greatly stimulated the development of centralized projects. In addition, a large number of large PV bases will be connected to the grid this year. Therefore, it is expected that the centralized market will increase greatly this year, and the installed capacity is expected to increase to 50-60GW.

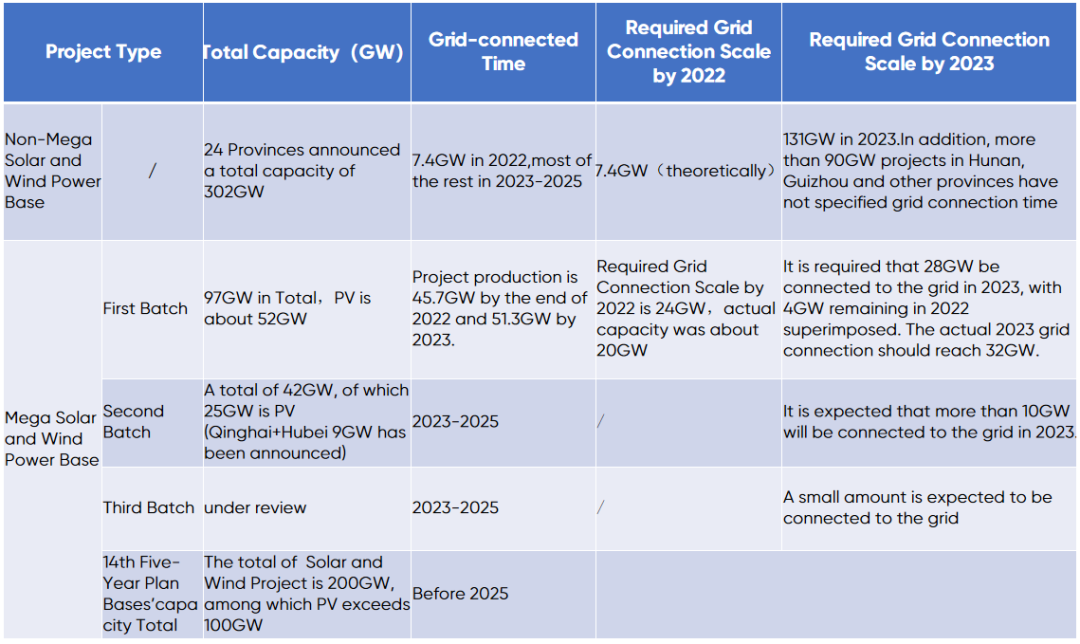

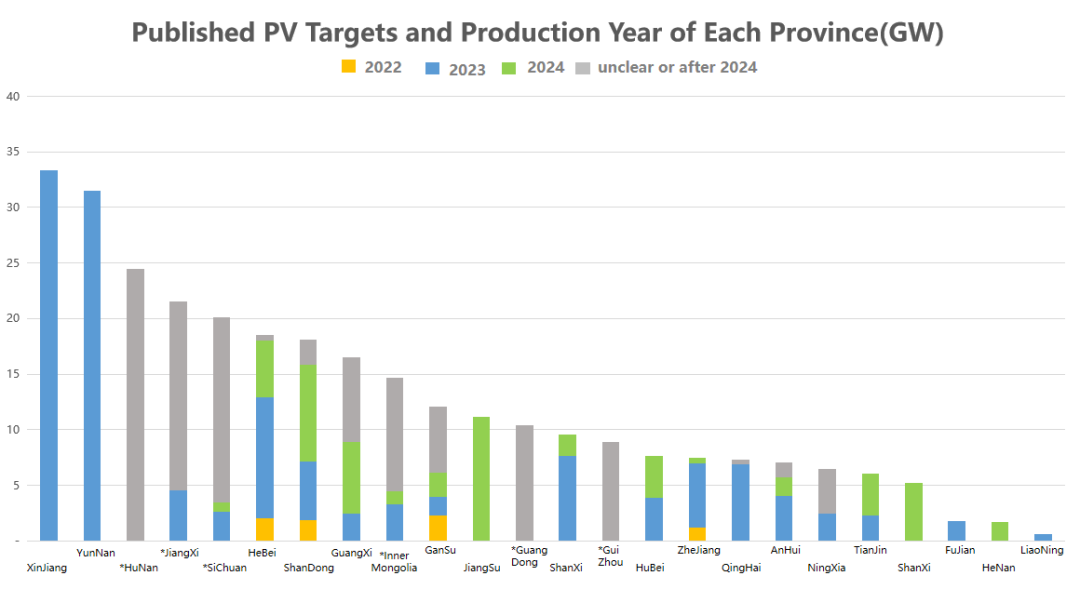

According to statistics, from 2022 to January 2023, a total of 58 batches of PV project scale indicators were issued by 24 provincial administrative regions in China, with a total scale of 302GW (mainly centralized), including guaranteed projects, market-oriented projects and other types. Among them, 131GW in 2023 and 54GW in 2024 are required to be connected to the grid at the latest. In Hunan, Sichuan and other places, the grid connection time of about 100GW is not specified, and some of them are expected to be put into production in 2023.

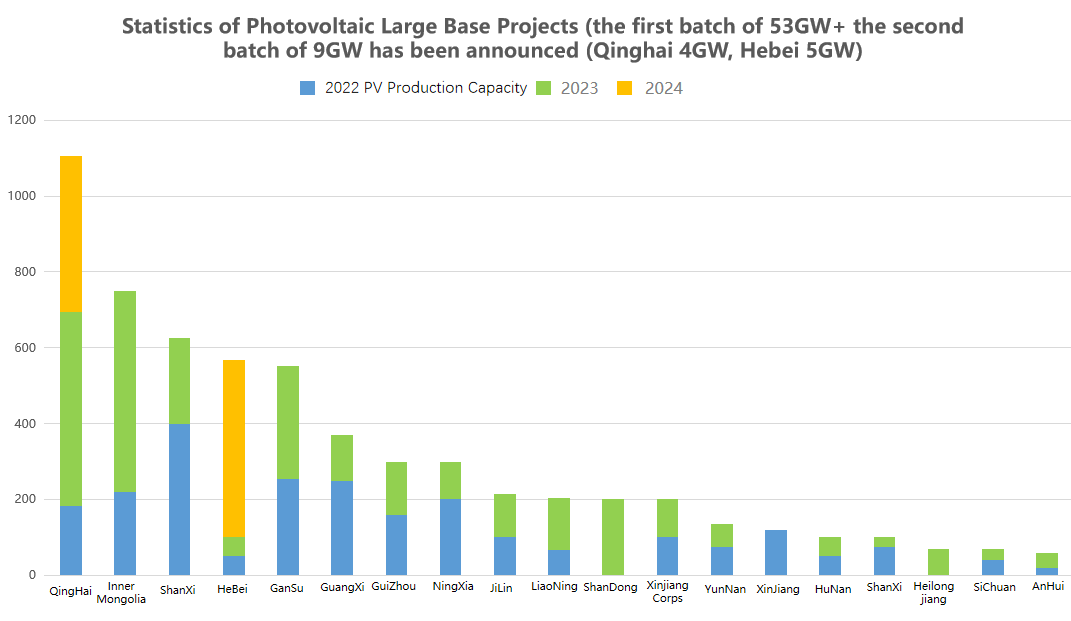

According to the "Planning and Layout Plan for Mega Wind and Solar Power Base Focusing on Desert, Gobi and Desert Areas" issued by National Development and Reform Commission and National Energy Administration, 200GW of Mega wind and solar power base is planned to be constructed during the 14th Five-Year Plan Period. Up to now, the indicators of the first and second batches of large bases have been issued. In the first batch of indicators, PV is about 53GW, of which 20GW has been connected to the grid in 2022, and the remaining 33GW is required to be connected to the grid in 2023. The second batch of large base PV projects are estimated to be 25GW, mainly including Gobi and desert projects in Inner Mongolia, Ningxia, Xinjiang, Qinghai, Gansu and other provinces, is expected in 2023 grid 10GW. 14 five PV large base indicators remaining 23GW, the third batch of large base project list is currently under review. According to comprehensive calculation, the grid-connected scale of PV large base alone is expected to reach 43GW in 2023.

03 China's Distributed PV Market Forecast in 2023

In 2022, Shandong, Hebei and other large traditional PV installation provinces successively experienced serious consumption difficulties. Therefore, the growth of these regions is expected to slow down this year. Expansion of the boost end is required to increase the PV power consumption capacity. At the same time, many places such as Shandong recently issued the time-of-use price policy, which will lead to the decline of PV power generation on-grid income, urge the power station investors to configure the energy storage system, increase the overall investment cost of the PV system and restrain some investment enthusiasm in the short term.

However, the development of PV has always been a major policy firmly implemented by the country. Meanwhile, the price of PV modules will fall this year, which can hedge part of the energy storage cost. In addition, in some economically developed provinces, such as Zhejiang, Jiangsu and Guangdong, the cost of industrial and commercial power consumption is high, and the installation of PV+ energy storage system has a better yield, so the development potential in the industrial and commercial PV field is promising.

It is expected that in 2023, the newly-added distributed installed capacity in China will maintain the scale of last year or slightly increase, at 50-60GW, with the distributed market of industry and commerce being more resilient.

04 What is AKCOME's layout in Chinese Market in 2023?

At present, Akcome has a number of product lines such as AK iPower, AK iChaser and AK iTopper, which comprehensively covers ground power stations and distributed application scenarios of different scales. The professional project design team can provide high-performance, high-input-output and high-safety PV system solutions according to customer requirements. At the business level, independent business teams and support teams have been set up for customers in various business types, such as state-owned enterprises, EPC enterprises, distributors and so on, in anticipation of providing the most relevant services for each target market.

Answering Time: 8: 00-17: 00 on weekdays

HQ: 0571-89089399

Sales: +86-512 8255 7328

Mail: modulesales@akcome.com

Headquarters: Room 901, Building 1, No. 1818-2, Wenyi West Road, Yuhang Street, Yuhang District, Hangzhou City, Zhejiang Province